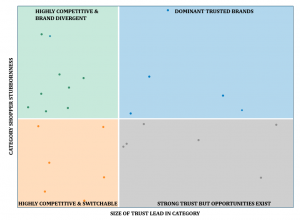

In my previous blog post, I introduced the BrandSpark Shopper Trust & Stubbornness Framework (BSTSF) model as a way to gain deeper understanding of category trust dynamics, and highlighted the importance of understanding which quadrant your category is in when devising your marketing strategy. Today I’m going to delve little further into the “High Stubbornness” quadrants, and provide a high level overview of what the implications of being in each of these quadrants are for brand strategy – for both leading and lagging brands.

Figure 1. 2019 Food categories plotted in the BSTSF

Source: BrandSpark International. www.brandspark.com

The Dominant Trusted Brand Quadrant

Brands that find themselves as leaders for categories in the upper right quadrant are in a dominant category position – a huge lead on trust, with shoppers quite reluctant to switch to their next closest alternative. It really can’t get much better than that.

For brands in this leadership position, any marketing strategies around stubbornness are primarily around long-term defense – particularly monitoring their key conviction metrics to ensure strength is maintained, and considering what (if any) specific investments might be made to assist. But the reality is investments likely won’t have a hugely significant impact on short-term results, given the shopper conviction already in place. And brands in this position are also generally in a position to maintain a strong price premium.

For other brands who are not the leader in the category, short-term options are relatively limited. The key focus here should be on differentiation, either targeting specific niches of shoppers that might be won over and are relatively new to the category (think new Canadians) or truly breakthrough product innovation (not just a flavor change!) . Longer term, focus should be placed on reducing category shopper stubbornness by closing key perceptual gaps with the leader, starting with key target segments. While these might not pay huge immediate dividends, it could – over time – move the category dynamics to a place that creates a far wider range of strategic opportunities.

The Highly Competitive and Brand Divergent Quadrant

“Tribal” is the best word to use to understand this quadrant. Here the leading, 2nd (and sometimes 3rd, etc.) place brands are relatively close in the share of shoppers that select them most trusted. Each group functions like a devoted tribe. Think about the classic “Ford! Chevy!” argument – shoppers choose their camp and become entrenched.

For categories in this quadrant, relatively little can be done in the short-term to get shoppers to switch brands unless something significant changes. This means short-term price discounting is usually to be avoided, as it will rarely attract enough new sales at compensate for regulars purchasing at lower prices, or win many new long-term customers.

In the event of significant innovation that might reasonably win shoppers over, marketing focus should be particularly focused on the planning stages of the path to purchase, and generating sufficient amounts of comprehensive and positive reviews. Those with deeply held beliefs likely won’t change their minds without doing a significant amount of research, so you have to get them thinking about it well before they are at the shelf.

There is also a clear benefit to reaching shoppers before they lock-in on their preferred brands, which means a particularly heightened focus on younger shoppers, and those going through a major life transition. One example BrandSpark has found is that when people have children, they go through a period of open mindedness where they are more receptive to considering alternative brands across many categories – before locking in on their (sometimes new) preferred choice for the long-term. Brands in this quadrant should particularly consider chasing these new parents hard.

In a few weeks I’ll post about the last two quadrants. Alternatively, you can check out the webinar here to learn more.